“Our strategy to grow the workforce cannot just be about training, it must be about meeting the needs of families. That’s why my workforce proposals also include things like housing, affordability, and jobs.” – Governor Phil Scott, 2022 State of the State Address

“This is what can be achieved this session: Major additions to our education system that make it the best in the nation. Good jobs and an affordable cost of living, so families can prosper. And safe and healthy communities with thriving town centers that – along with our incredible natural resources – offer the best quality of life in the nation. This benefits the people here now and gives us the workforce recruitment tools we need.” – Governor Phil Scott, FY23 Budget Address

Growing the Economy:

Economic Expansion

Expanding and Strengthening Vermont's Workforce

Creating a Cradle-To-Career Education System

Making Vermont More Affordable:

Fiscal Discipline and Responsible Tax Relief

Making Housing More Affordable & Creating Construction Jobs

Modernizing State Government

Reducing Costs for Families & Businesses

FY '23 Proposals

Affordability

- Expanding the fully refundable Earned Income Tax Credit (EITC), one of the most successful antipoverty programs in the country, to 45 percent of the federal credit provides supplemental income for low- and moderate-income families, especially those with children. It would tie Vermont as the most generous fully refundable EITC in the nation, and because it is based on earned income, it provides an incentive to participate in the work force.

- Expanding the Child and Dependant Care tax credit to 65 percent of the federal credit, eliminating the current eligibility tiers, and making it fully refundable for all qualifying Vermonters, will help make childcare more affordable for Vermont families.

- Allow all Vermonters paying interest on student loans to deduct the interest paid on these loans from income to the extent that it has not already been deducted at the federal level. Taxpayers who paid qualifying student loan interest receive form 1098-E from their loan servicer and report those amounts for federal income taxes.

- Increase the income thresholds for the Vermont Social Security income tax exemption by $30,000. H.558 presently contains language increasing the thresholds by $10,000, applying to FY2022 and beyond. We are encouraging the Legislature to go a step further than H.558 in current form and increase the thresholds by $30,000.

- Exempt military income and surviving spouse benefits from income tax. Currently, H.597 as introduced would create this exemption.

- Return up to $45 million of the forecasted Education Fund surplus to property taxpayers via rebate checks. We are excited to work with the Legislature and municipal stakeholders on this proposal.

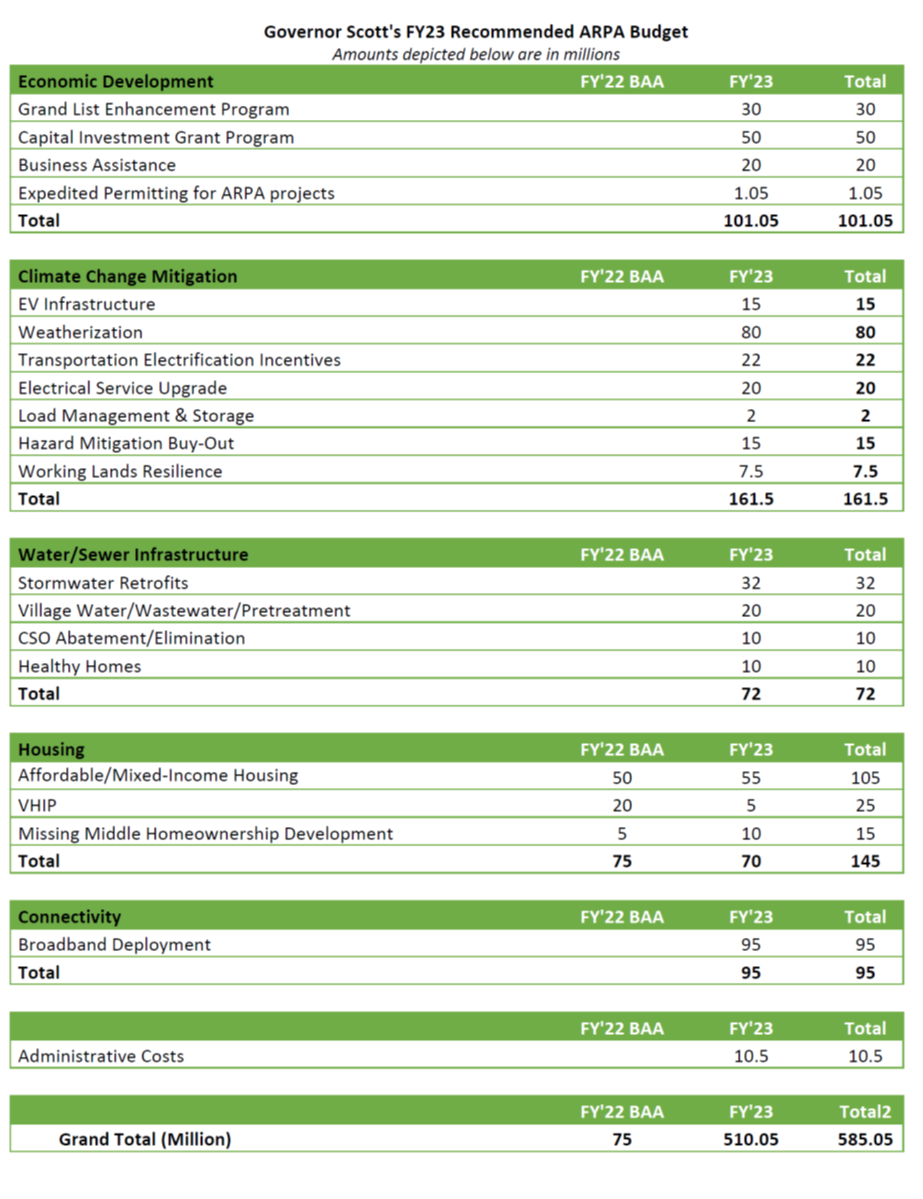

American Rescue Plan Funding:

Publications

-

Governor Phil Scott: We Must Act Now on Our Housing Crisis

-

Commissioner Goldstein: To Secure the Future We Want, We Need to Invest Now

-

Commissioner Bolio: Comprehensive & Progressive Tax Relief for Vermonters

-

Secretary Kurrle: Military Pensions: We Need to Stop Making it Easy for Highly Skilled Job Seekers to Choose Anywhere but Vermont

-

Secretary Kurrle: The Race to Attract New Vermonters is too Important to Ignore

-

Commissioner Tierney: “Can You Start Over, Your Call Dropped…”

-

Secretary Tebbetts & Secretary Kurrle: Governor’s Budget Recognizes the Importance of Farm and Food-based Economy